U.S. Department of Treasury Announces Its First-Ever National Strategy for Financial Inclusion

Nov 08, 2024

The Need for a More Inclusive Financial System

The U.S. Treasury Department has unveiled its first-ever National Strategy for Financial Inclusion, and it’s a huge step toward ensuring that all Americans have access to safe financial products.

Terra Neilson, Chief Impact Officer at Beneficial State Bank, emphasizes how critical it is for building a financial landscape that serves everyone, especially those who have historically been left behind.

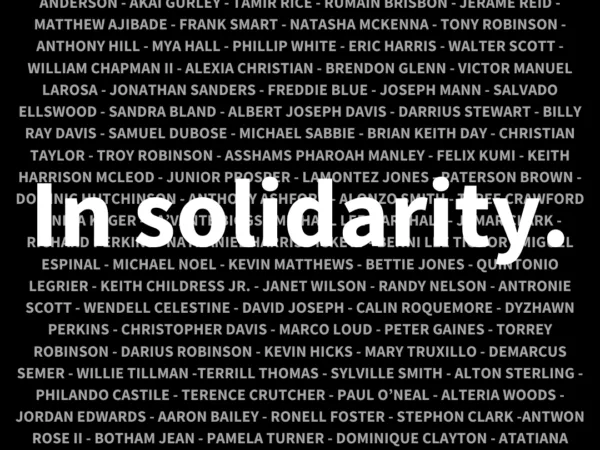

“In announcing this strategy, the federal government is recognizing what Beneficial State Bank has long believed and advocated for: that we must work proactively and collaboratively to build a more inclusive financial system,” says Terra. “The financial industry has historically benefited from slave labor, engaged in biased practices like redlining, and perpetuated deep inequities through modern-day predatory lending. While laws now prohibit such overt discrimination, the impacts persist: white families’ median net worth is nearly 10 times higher than that of Black households, according to data from the U.S. Federal Reserve.”

For too long, practices like redlining and predatory lending have perpetuated inequality. The U.S. Treasury Department’s new plan aims to bridge that gap.

What the U.S. Treasury Department’s Strategy for Financial Inclusion Includes

“With this new plan, we have a roadmap for connecting individuals to the banking system, increasing access to affordable credit, improving transparency, and enforcing fair lending laws,” explains Terra.

The full report lays out a clear roadmap for:

- Connecting more individuals to essential banking services.

- Increasing access to affordable credit.

- Enhancing transparency in lending practices.

- Enforcing fair lending laws to protect consumers.

The Positive Impact of Financial Inclusion

“The result will be more individuals and families able to navigate the financial system and build generational wealth,” says Terra. “The time for incremental change has passed. I urge our fellow financial institutions to join us in implementing the Treasury's recommendations and taking bold action to build a transparent, equitable banking system that serves to reduce economic disparities and create opportunities for all.”

We celebrate this important shift toward a more inclusive financial future and look forward to joining banks nationwide in strengthening our collective efforts to make banking more inclusive.

Learn more about Beneficial State Bank’s Financial Wellness resources and read the full U.S. Treasury Department’s report to dive deeper into this topic.

We're Proud to Be a CDFI

Our impact as a Community Development Financial Institution is rooted in our commitment to shared prosperity. We're proud to be one of nine CDFI banks on the West Coast.

Choose a Bank that Invests in Tomorrow

Beneficial State Bank serves the triple-bottom-line of people, planet, and prosperity for all. That means prioritizing social justice and environmental sustainability. Our clients want to see their money put to good use – funding causes that defend our planet and build resiliency in our communities. Change your bank and help change the world.

Spotlight on Social Justice

We advocate for a more just world where all of us have the opportunity to build vibrant, healthy, and free lives.